Organizations build on effective functional software. What about non-budgeted costs, contract risks and governance damages?

Who is the software licenses owner who is responsible for licensing agreements and licensing risks? Is it the holding, a subsidiary or the external services provider for the desktop deployment? Software licensing contracts often stipulate that licenses may not be deployed in other organizational entities or by other organizations. When considering a managed software service (License Management as a Service) or in divestures and mergers this can become a hot item, possibly followed by negotiations with a series of software publishers. Modern license management solutions have granular ways to assign software usage and costs to divisions, business units, projects, etc. Services outsourcing and business divesture need not to be a threat when software license re-use is contained in the software license agreement. Finance and procurement should be leading this challenge.

| Software licenses represent a high value on the balance sheet. Yet there is little attention for managing software assets, introducing over-usage and overspend. Software takes over 30% of the IT budget. Yet, 40% of desktop software is barely used and 25% of desktop software is licensed incorrectly. The server domain also has its challenges: over 50 % of all physical servers supports virtualisation. Database suppliers Oracle and Microsoft and virtualisation supplier VMWare each deploy different metrics to license their software. The user is responsible for the correct licensing of each fysical and virtual host, even when only used for seconds in a stand-by configuration. There is a permanent state of risk, where CFO, CIO and procurement should team to avoid contract risks and budget assaults. |

The CFO acts on operational and ‘mission critical’ information in his Dashboard:

- the financial angle: assets and liabilities per cost center

- the operational angle: expansion opportunities per cost center

- governance accountability: license compliance

- risk perception: deviation from the contracted entitlement volume

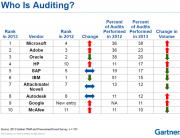

- audit trails

Licensing models and payment schemes ( cash, financing, lease – on/off balance -) determine capitalization, directly impacting the 3 to 5 years Total Cost of Ownership (TCO). The savvy CFO will not hesitate to team with the CIO and procurement to take control over software licensing cost figures.

Leave A Comment

You must be logged in to post a comment.